VALUATION AND CREDIT ANALYSIS

The first one is an equity research report done on Capcom. Equity research is effectively issuing a value for a company's stock and its very easy to get the company valuation from here, if desired. Multiplying stock value by shares outstanding gives equity value. If you add market value of debt, you can get enterprise value as well.

SUMMARY

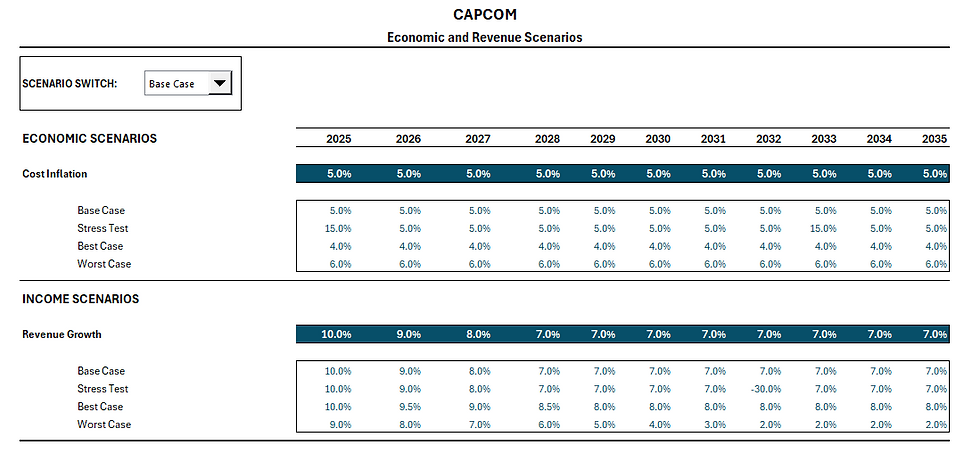

Capcom is primarily a videogame production company, though they also have business in arcades and amusement operations. Capcom has positioned itself well in the industry with its unique IP that has generated a consistent fanbase. Other factors, such as a strong management team and above-average treatment of ESG factors help the company outperform peers in some important respects, such as net margins. It was assumed that Capcom's revenues would growth with the industry over the next decade at 7%, and that costs would increase at a historical average CAGR of 5% in the base case. The FCFE valuation suggested that Capcom was slightly undervalued but this is probably unconvincing considering the magnitude of the difference relative to the forecast horizon. Residual income suggested the stock was overvalued but the book values are unlikely to capture the full picture. Based on the peer valuation and comparison statistics, Capcom may be more efficient than competitors at allocating capital or could be in a higher growth stage (although the company has been in business for 46 years!), leading to much higher relative valuations. This could be supported by above industry average revenue growth over the next decade, which, would imply its stock is materially undervalued. In any case, other aspects of Capcom's financial statements such as its high interest coverage ratio and cash ratio, suggest the investment is relatively low risk (additionally supported by its IP's consistency, ESG factor analysis, performance in stress test scenario, and below market beta). All-in-all, the stock is rated a buy and is likely 5-10% undervalued based on the FCFE modeling and more conservative bonus for the relative pricing. For a definitive 'buy' recommendation, greater main-line IP diversification should be achieved, and perhaps greater use of debt would bring Capcom closer to an optimal cost of financing. Investors should also keep in mind all of the potential risks associated with the forecast, company, and industry.

BUSINESS DESCRIPTION

Capcom Co., Ltd., headquartered in Osaka, Japan, is a leading global developer, publisher, and distributor of video game software, known for its rich portfolio of internationally recognized franchises. Founded in 1979, Capcom has built a durable competitive advantage through a combination of original IP development, high-quality in-house production, and effective digital content monetization strategies. The company operates across three core business segments: Digital Contents, Arcade Operations, and Amusement Equipment. Management appears strong and has focused on growth- with targets for operating income growth at 10% annually, which would extend Capcom's 11 consecutive years of improved operating income, and long term sales goals of 100 million units annually. They plan to do this by expanding their reach into countries their products have yet to be distributed in, while leveraging their unique IP and emphasizing max sales over a 5-year period, rather than within any 1-year using a dynamic pricing model. Capcom appears to take an active stance on ESG factor improvement, which will likely lend to sustainable growth.

Main Market: Capcom operates primarily in the global video game software market, across more than 230 countries and regions, with North America and Europe as its largest revenue-generating regions outside Japan. These regions account for a significant share of sales, particularly for flagship franchises such as Resident Evil and Monster Hunter. The company has a strong foothold in Asia, especially in Japan, where it also maintains arcade and amusement businesses. Digital distribution platforms such as Steam, PlayStation Store, Xbox Live, and Nintendo eShop have enabled Capcom to expand its direct-to-consumer sales, contributing to over 90% of its unit sales coming from digital channels as of FY2025. Capcom is looking to expand into new markets- which they plan to do over the next 5-10 years by 1. hiring personnel with expertise in international business and 2. expanding the awareness of their products and brands in markets that are not yet economically ready to promote videogames.

Digital Contents: The Digital Contents segment is the cornerstone of Capcom’s business, encompassing development and sales of home video games for consoles, PCs, and mobile platforms. Capcom's strength lies in its globally popular franchises, including Resident Evil, Monster Hunter, Street Fighter, and Devil May Cry. The company emphasizes a "Single Content Multiple Usage" strategy, monetizing titles across various platforms, media formats, and geographies. In recent years, Capcom has increasingly shifted toward a digital sales model, with downloadable content (DLC), back-catalog sales, and high-margin digital distribution comprising the bulk of segment revenues. This shift has allowed them to sell their contents globally for longer periods of time, reduce production costs, and be more flexible with their pricing. This is also part of Capcom's carbon-emission reduction strategy.

Arcade Operations: This segment includes the operation of amusement facilities across Japan. While structurally in decline due to demographic shifts and the broader digitization of entertainment, Capcom continues to manage this segment profitably by leveraging popular character branding, tightening cost controls, and focusing on experiential entertainment offerings that cannot be replicated digitally.

Amusement Equipment: Capcom also develops and sells software and equipment for pachislo (pachinko slot) machines. This segment is cyclical and regulated, yet provides a supplementary revenue stream by leveraging the company’s game IP in a new format, such as Resident Evil-branded machines.

IP-Driven Diversification: Capcom leverages its powerful IP across media, merchandise, esports, and film/TV adaptations. The Resident Evil film and television franchises and recent moves into esports through Street Fighter events have helped expand brand equity beyond traditional gaming. Movies can allow efficient portrayals of game stories, enabling the capture of additional market share. This multi-channel approach also enhances customer engagement and provides synergistic cross-selling opportunities. However, while multi-media approaches help with marketing and branding, Capcom primarily leverages its unique and popular IP through game content.

Global Reach and Development Philosophy: Capcom maintains a hybrid development model, emphasizing in-house game creation to retain creative control and cost efficiency. With development talent concentrated in Osaka and Tokyo, Capcom has built a reputation for high production quality and consistent delivery. Its global publishing capabilities enable localization and distribution across key markets, with a major focus on North America, Europe, and Asia. As part of cost-cutting initiatives in 2020, more development was moved in house.

Strategic Positioning and Differentiation: Capcom distinguishes itself through (1) a focus on action and horror game genres, (2) the ability to sustainably monetize long-tail IP through digital remasters and remakes (e.g., Resident Evil 4 Remake), and (3) strong cost control with industry-leading operating margins. The company has shown adaptability to technological trends, such as next-gen console optimization, PC-centric releases, and online multiplayer features.

Expenses: Capcom has maintained strong cost discipline, with operating margins around 38% in FY2024, among the highest in the industry. Key expenses include R&D, and SG&A. Internal development of new IP is capital intensive, with high fixed costs but high returns from successful new IP. By emphasising the reuse of game engines, long-term development costs can be reduced. The growing share of digital distribution has decreased reliance on physical supply chains, reducing certain operational costs. Capcom's marketing spend is primarily focused on flagship title launches and global esports events. Headcount growth in development teams is aligned with IP expansion plans, and will be expected to increase in the future as business expands and talent acquisition efforts increase. Historically, management has been effective in keeping SG&A as a percentage of sales relatively flat. In FY2020, there was a relatively large increase in Capcom's net margin, this was clearly the result of EBITDA margins increasing to about 50% as the result of cost cutting in the form of digitalization of sales, streamlined production, and shift to in-house production, all of which appear to be sustainable.

Capital Structure: Capcom maintains a conservative capital structure, and has been steadily decreasing their debt to equity ratio over time. Capcom finances game development and global expansion using mostly retained earnings rather than debt, which would be expected to lower their overall cost of financing (however, cash is not free and is still considered distributions that could be issued to equityholders, thus contributing to cost of capital as though it were equity). Additionally, their high-margin digital content business generates substantial free cash flow, allowing Capcom to fund development pipelines, repurchase shares, and pay dividends. Capcom aims to increase corporate value by improving profits, and has consistently paid dividends, with a target payout ratio of around 30%. Capcom likely has the capacity to increase their target payout ratio to 40% or higher long-term.

INDUSTRY OVERVIEW

The global video game industry is a rapidly evolving sector within the broader entertainment landscape, encompassing console, PC, mobile, and cloud gaming. It is modestly exposed to the business cycle, with sales down in 2007-2009 but up during 2021, for example. It remains a relatively inexpensive form of entertainment, though newer games at the $70 USD per unit mark may suffer during downturns in particular. As of 2024, the industry is valued at approximately $220 billion USD in annual revenues, with historical CAGR of approximately 7% that is likely to continue over the next decade, driven by expanding digital infrastructure, cross-platform accessibility, and the monetization of live-service models. Accordingly, there are approximately 3.3 billion people worldwide that play video games, with about 1.5 billion on PC and console.

Capcom holds a unique and defensible niche in the global gaming ecosystem. As a mid-sized, Japan-based developer and publisher with a portfolio of enduring IP, it has established itself as a top-tier creator of high-margin, single-player and fighting games. While it does not compete at the scale of mega-cap publishers like Tencent or Activision Blizzard, Capcom benefits from strong brand equity, cost efficiency via its proprietary RE Engine, and a robust catalog monetization model. The video game industry is highly competitive and fragmented, with companies competing on IP strength, development capabilities, and platform access.

Console and PC Gaming (~50% of global market share): Dominated by AAA franchises, with recurring revenue models via downloadable content (DLC), subscriptions, and in-game purchases.

Mobile Gaming (~45% share): The fastest-growing segment, supported by lower barriers to entry, freemium models, and increasing monetization of casual and competitive mobile titles. Mobile has been traditionally difficult for Capcom's products to penetrate, as performance capabilities are lower in this segment. Over time, devices will likely improve, lending to increased sales in this area.

Cloud Gaming and Subscription Services (<5% but rising): Xbox Game Pass and PlayStation Plus have been shifting value from unit sales to engagement time. While there is still room for innovation in this area, its unlikely to continue capturing increased market share indefinitely because, although an economical option, many gamers have developed loyalty to specific titles, increased interest in free to play options, and increased aversion to new titles, likely augmented by the volume of releases per year. Additionally, these services have been around for at least 10 years now with somewhat limited success.

Capcom competes primarily in the premium console and PC gaming space, which maintains strong growth and high-margin potential via digital distribution. It is worth noting that certain actions within the industry have faced increased consumer backlash such as releasing unfinished products, microtransactions, and certain developers, such as Blizzard, moving towards mobile games. For a company such as Capcom, that may rely on hardcore fanbases for game franchises such as Devil May Cry, these actions may particularly hurt, although they have yet to receive backlash for these actions and the tradeoff will still very likely to lead to higher revenues, especially if they can do so without alienating their main fanbases.

Digital Distribution and Back-Catalog Monetization: Over 90% of global game sales now occur digitally, reducing distribution costs and increasing profitability for developers. Catalog titles remain a significant revenue driver through platforms like Steam and the PlayStation Store, allowing publishers like Capcom to monetize historical IP years after release.

Live-Service and Esports Expansion: Games-as-a-service (GaaS) models, including seasonal updates and multiplayer engagement (e.g., Street Fighter), are extending the revenue lifecycle of titles. Likewise, the use of 'Evergreens' (games that can be played indefinitely, such as Minecraft (not a Capcom title)) is increasing. Esports is a growing sub-sector, contributing both brand visibility and ancillary monetization opportunities through sponsorships and merchandise.

IP Ecosystem Development and Transmedia Strategy: Game publishers are increasingly expanding franchises into films, TV series, comics, and merchandise (e.g., The Last of Us and Resident Evil adaptations). This not only deepens user engagement but also diversifies revenue streams—an area where Capcom has been an early and ongoing participant.

Consolidation and M&A Activity: The industry has seen major consolidation, including Microsoft’s acquisition of Activision Blizzard and Sony’s continued investment in exclusive content. While Capcom remains independent, it is often cited as a potential acquisition target due to its valuable IP portfolio and strong balance sheet.

AI and Production Efficiency: Generative AI, procedural animation, and automation tools are increasingly being integrated into game development workflows to reduce time-to-market and increase asset reuse, aligning well with Capcom’s proprietary RE Engine strategy. This aspect will be unlikely to replace game developers any time soon, however, and will likely lend to smaller teams being more competitive in the market and larger teams producing more mechanically and visually impressive games instead.

SWOT Analysis

Strengths: Iconic, high-performing IP (Resident Evil, Monster Hunter, Street Fighter); Proprietary RE Engine increases development efficiency; High digital sales ratio and strong margins; low-debt, cash-rich balance sheet; Long-tail monetization of catalog titles.

Weaknesses: Limited new IP generation in recent years; Underpenetrated in mobile and live-service segments; Smaller global footprint vs. Tencent, Sony, or EA; Heavy reliance on cyclical AAA titles; Conservative marketing strategy vs. Western peers.

Opportunities: Expansion of franchises into mobile, film, anime, and merchandising; Growth in esports and live-service monetization (e.g., Street Fighter 6); Increased global demand for Japanese content/IP; AI tools to reduce production costs and timelines.

Threats: Intense industry competition for consumer time and spend; Platform risk due to dependence on Sony, Microsoft, Steam; Currency risk (yen volatility vs. USD and euro); Regulatory scrutiny over content, loot boxes, and labor.

Porter's 5 Forces Analysis

Competitive Rivalry: High; Capcom competes with global giants (EA, Activision Blizzard, Sony, Nintendo). Success depends on consistent high-quality releases.

Threat of New Entrants: Low; High development costs and IP barriers limit new competition, though indie developers can disrupt niches via platforms like Steam over a long period of time, provided they bear employment costs and the significant uncertainty of product launch. This threat will likely increase as AI rapidly improves, removing barriers for small teams to create high quality videogames.

Bargaining Power of Suppliers: Moderate; Most development is internal. However, console and pc platform holders (Sony, Microsoft, Steam) extract significant distribution fees (~30%).

Bargaining Power of Buyers: Moderate; Gamers have many choices and often wait for discounts. Brand loyalty and IP value reduce switching, especially in Japan and NA. There are certain titles Capcom offers that give unique experiences as well, such as Dragon's Dogma, Monster Hunter, and Devil May Cry that other developers have failed to imitate in a convincing manner.

Threat of Substitutes: Moderate; Substitutes include TV, streaming, mobile apps, social media, and non-gaming entertainment. Engagement time is a scarce resource.However, despite many substitutes, most 'gamers' are dedicated to games as their main entertainment source. It is also worth noting that there is a subset of the market that is practically exclusively focused on non-mobile gaming as entertainment.

ESG CONSIDERATIONS

Capcom’s ESG profile is net positive for investors. Its high MSCI ESG rating (AA) and “Low Risk” Sustainalytics score indicate relatively low exposure to ESG-related business risks. Environmental initiatives (carbon targets, renewable energy, digital delivery) reduce potential costs from energy use and regulations. Social factors (high employee engagement, strong philanthropy) support Capcom’s brand, customer loyalty, and talent retention. The governance framework (committees, compliance, disclosures) is sound, reducing oversight risk.

Only a few negatives should be noted. The founder/family ownership (20%) concentrates power and may raise minority-shareholder concerns, though this hasn't appeared to be an issue. Climate reporting lacks quantified emissions targets (beyond 2050 net-zero) and many diversity metrics remain short of best practice. The 2021 EU antitrust fine was small (€7.8M) but serves as a reminder that compliance lapses can occur. Otherwise, Capcom has no glaring ESG liabilities (no environmental disasters, no strikes or major recalls, etc.).

The company’s proactive CSR and governance programs help manage long-term risks. Capcom’s ESG strengths—especially in corporate governance and social stewardship—thus likely add a modest premium to its equity valuation. Investors should, however, monitor progress on climate disclosures and diversity goals to ensure Capcom maintains its leadership status going forward.

Environmental Factors

Capcom’s business is primarily digital games, so its environmental footprint is relatively low. The company has set a target of net-zero CO₂ emissions by 2050 and has begun switching to renewable power: since mid-2023 about 27% of electricity used in its Japan offices has been from renewable sources. Over 70% of sales are digital content, meaning most environmental impact comes from offices and distribution. Some other key environmental initiatives include LED lighting and energy‐efficient equipment, plus digitizing game manuals. In FY2024 Capcom reports eliminating the need for ~45.9 million pages of paper by using in-game manuals, and saved resources equivalent to 41.35 million units of software through digital downloads. These efforts cut printing, packaging and transport emissions.

Renewables & Energy: Started using 100% green power at its Osaka sites (June 2022) and at Tokyo branch (April 2023); ~27% of its Japan power is now from renewables; Introduced “green” pachislo machines (low-power gaming machines) and reduced arcade game energy intensity ~7–8% since FY2019.

Digital Distribution: Shifted manuals and software online. Digital sales in FY2024 conserved resources (discs, packaging) equal to ~41.35 million game units and eliminated ~45.9M paper manuals annually. This both cuts waste and avoids transport emissions.

Operational Footprint: Capcom notes its CO₂ impact is low for a manufacturer because it makes mostly software; It encourages employees to live near offices (bicycle commuting, company housing) to lower commute emissions; It recycles used arcade machines (e.g. 99.8% recycling rate in FY2021).

Social Factors

Capcom’s social record shows active workforce programs and community giving. Employee engagement scores are high (work engagement ~54/100 vs target 55) and voluntary turnover is very low (~2.9% in FY2024). The company provides robust family leave: in FY2023 76.9% of eligible employees took childcare leave (66.7% of men, 114.3% of women), with 100% returning to work. Women constitute about 21.2% of Capcom’s workforce (higher than many Japanese game firms) and ~12% of managers. Capcom has introduced policies (paid maternity/paternity leave, childcare leave, flexible hours) to improve gender balance and has set formal targets to raise paternity leave uptake (to 85%) and narrow the male/female pay ratio to ~88% by 2028 (currently ~83.8%). It employs ~216 foreign nationals (6.8% of staff) and supports them with housing and language programs.

Workplace & Diversity: Capcom’s employee survey shows strong commitment (e.g. ~86% are “glad to work” at Capcom); It has global anti-harassment training and a 24/7 ethics hotline; The relatively low female/manager ratio and some gender pay gap are being addressed through targets; Foreign employees are integrated via relocation support and feedback meetings.

Employee Welfare: The company provides internal awards, recreation facilities and extensive benefits to improve retention. These efforts helped halve turnover from 5.4% (FY2022) to 2.9% (FY2024). There are no union issues reported. Capcom has also set sights on improving training systems, which should contribute to improved talent acquisition and retention.

Community & Philanthropy: Capcom invests heavily in social contributions. In FY2024 it donated a total of ~¥90 million to child welfare causes (e.g. ¥50M to a children’s fund, ¥30M to Save the Children); It also contributed ¥120M to Japan earthquake relief, ¥20M to UNHCR (Ukraine), and ¥10M to Taiwan quake relief; The company leverages its gaming IP for civic causes (e.g. crime-prevention and voter-awareness programs with police and election boards); Capcom is an official sponsor of sports teams (Cerezo Osaka soccer, national volleyball) to support local culture.

Consumer Safety & Ethics: Capcom follows industry standards for game ratings (CERO/ESRB/PEGI) and has a published privacy policy for user data. No major product recalls or safety incidents are noted. Controversy: In 2021 Capcom (with Valve and other publishers) was fined €7.8 million by the EU for anti-competitive “geo-blocking” of PC games. This past antitrust breach is its most significant public consumer‐facing issue. One other noted social factor is that Capcom’s amusement segment produces pachinko (gambling) machines – an ethical concern flagged by some observers. Additionally, some regulatory bodies have pushed back against violence in video-games, however, this is not specific to Capcom and hasn't appeared to significantly affect the industry in its main markets as of yet.

Governance Quality

Capcom emphasizes transparent, “sound” corporate governance. It has formal Corporate Governance Guidelines and annual governance reports, and it employs a typical Japanese company-with-auditors model. The Board of Directors is chaired by founder Kenzo Tsujimoto (age 84) alongside 12 other directors. Several external, independent directors (e.g. Tatsuro Mutoh, Kotani Wataru, Toru Muranaka) serve on the Board and chair key committees. In practice the Board has a Nomination & Remuneration Committee and an Audit Committee (each chaired by an outside director) – a best practice introduced in 2015. Capcom has a corporate‐officer system separating oversight (Board) from execution (officers).

Control & Ownership: Tsujimoto family influence remains significant. Crossroad Co. (affiliated with Kenzo Tsujimoto) holds ~10% of shares, and Tsujimoto family members hold additional stakes (cumulatively ~20%). No dual-class shares are reported (one-share/one-vote applies). Shareholders’ meetings are held annually; Capcom discloses voting policies.

Audit & Compliance: Capcom has an Audit & Supervisory Committee (effectively an audit committee) with 15 full-time audit staff. This body audits management according to a strict audit charter. The company also has a Code of Conduct requiring all employees to comply with laws and regulations, enforced via training and compliance checks. Risk management is cross-functional by policy. An Internal Audit Department (reporting to the Audit Committee) exists to verify financial controls.

Board Effectiveness: The Board includes six external directors; three external directors sit on Audit and Remuneration committees. Directors’ terms and performance evaluations are addressed via the Nomination Committee (external-chair). Capcom publishes the rationale for appointing external directors and their compensation schemes. Overall, the governance framework meets or exceeds Japanese exchange standards.

Controversies & Rights: The EU geo-blocking fine in 2021 indicates past lapses in compliance. No major governance scandals or shareholder-rights disputes have emerged. Capcom did not report any Code of Ethics violations. In late 2023, Capcom instituted changes to comply with new Japanese disclosure rules (e.g. DGCL-style corporate governance reforms) and claims continuous oversight improvements.

ESG Ratings & Benchmarks

Capcom’s ESG metrics are strong by industry standards. MSCI has given Capcom an AA rating (on a AAA–CCC scale) as of January 2025, placing it in the top tier of Japanese media companies. Sustainalytics’ ESG Risk Rating for Capcom is 19.1 (low risk), comparable to peers like Nexon (18.3) and Konami (19.1). In Sustainalytics’ gaming software sub-industry Capcom ranks roughly 310th out of 941 companies, suggesting Capcom has low unmanaged ESG risk relative to competitors. Capcom was recently added to the MSCI Japan ESG Select Leaders Index, reflecting its leader status. Other datasets (e.g. CSRHub) similarly classify Capcom as medium-risk (the firm’s own site cites a CSRHub D+ rating) – broadly in line with major gaming peers. Notably, no major ESG rating agency flags Capcom as an outlier laggard.

In the video-game sector, companies typically have moderate environmental impacts (due to digital products) and face social pressures (e.g. diversity, data privacy) and governance concerns (e.g. IP licensing). Capcom’s ESG profile compares favorably: its climate efforts (renewables, digitalization) and social programs meet or exceed industry norms, and its governance structures are robust.

POTENTIAL RISKS

Miscellaneous Risks: Some model risk, such as the breakdown of assumptions is present. For example, it is assumed the industry growth rate over the 10 year period will be 7% annually and then, at some point thereafter, converge to the GDP growth rate of 2%; obviously, reality can differ from projections. Additionally, other assumptions such as assuming the currency adjustments will net to zero over the period, could prove false.

IP Concentration & Franchise Dependency: Capcom’s revenue is heavily tied to a handful of “mega” franchises (Resident Evil, Monster Hunter, Street Fighter, etc.), which collectively account for the vast majority of game sales. For example, Capcom’s top three series have sold well over 300 million units worldwide. A failure in any core franchise – due to weak content, development issues or shifting consumer tastes – could materially hurt earnings (Capcom has noted that “if the market environment changes or if there are any defects or issues” with its key titles, it risks losing users and revenue). The company seeks to mitigate this by continually releasing new entries in its established IP and developing new IP to broaden its portfolio and user base, but the hit-driven nature of AAA games remains a fundamental risk.

Competitive and Market Trends: The video game market is intensely competitive and dynamic. Capcom competes not only with other major console/PC publishers (e.g. Nintendo, Sony’s in-house studios, Activision Blizzard, Ubisoft, etc.) but increasingly with mobile and free-to-play platforms, streaming services and alternative entertainment. Games are a discretionary “luxury good” for consumers, and Capcom’s success depends on sustained player interest. The company warns that strong interest in other forms of leisure or new channels could depress game sales. Capcom must keep pace with evolving consumer preferences (e.g. demand for live-service games or mobile formats) or risk market share loss. Management counters this by expanding into new platforms (mobile titles using its IP, PC releases, etc.) and monetization models, but disruptions (such as regulatory crackdowns on loot boxes or a failure to capture a younger audience) remain a strategic risk.

Technology and Platform Risk: Capcom’s business relies on the health and cycles of game platforms. The company notes that delays in new console hardware or rapid technological shifts can cause “sales opportunities to be lost”. Historically, game companies see lulls as gamers postpone purchases around console transitions. Capcom also depends on licensing agreements with console makers (Sony, Nintendo, Microsoft) – changes to those terms or any issues with a platform (e.g. hardware defects, back-end failures) could hurt Capcom’s releases. To mitigate this, Capcom diversifies release across all major platforms (including PC) and invests in its proprietary RE ENGINE technology to adapt to new hardware. Nevertheless, any major shift (such as a failed console launch or emergence of disruptive platforms) could negatively impact sales. Additionally, new technologies pose risks in the form of changing consumer behaviours and new competitive products.

Development Execution: Modern games require huge investments and long development cycles. Capcom acknowledges that “development costs have been rising steeply” and that it may fail to recoup costs if titles do not meet sales targets. The complexity of game development creates risk of delays or quality shortfalls. Management strives to mitigate this by using its in‑house RE ENGINE, allocating skilled developers efficiently, and controlling budgets. In practice, Capcom has expanded development capacity (adding ~100 new staff per year and building new studios) to meet demand. Still, any project overruns or tech bottlenecks could result in missed launches or exceeding their budgets.

Talent Retention and Human Resources: The video game industry is highly competitive for talent. Capcom’s own disclosures note that “mobility of personnel is relatively high” and that losing key developers to rivals can disturb its projects. A prolonged hiring boom (plans to hire 100 new staff annually) also raises the challenge of recruiting and integrating many new employees. Capcom seeks to mitigate turnover by improving workplace culture (direct communication channels with management, enhanced welfare programs, etc.) and expanding facilities. Nonetheless, a shortage of skilled developers or high attrition could slow game production or erode quality.

Seasonality and Product Lifecycle: Game sales are lumpy by nature – with major spikes in holiday quarters – and depend on hit releases. Capcom warns that demand “fluctuates substantially throughout the year”, so quarterly results can be quite volatile. A poorly timed release (or an unexpectedly successful one) could swing earnings. The company tries to smooth this by lengthening product lifecycles (supporting titles longer through downloadable content, price promotions and digital sales), still, the vast majority of sales per release occur in the first year (~70% expected). Nonetheless, over-reliance on a few annual releases means that a delayed title or weak holiday season can significantly drag on results. Additionally, video games are discretionary consumer spending. A global or regional economic downturn (e.g. recession, inflationary stress) could reduce consumer budgets for entertainment, delaying purchases of big-ticket games or hardware, and generally increases competition in the market as consumer choice narrows. Game spending often holds up moderately well in downturns, but prolonged economic pain could temper growth.

Information Security and IT Systems: Capcom stores extensive proprietary game data and customer information. It recognizes the risk of cyberattacks or data leaks, which could disrupt development or harm its reputation. Capcom has established an IT Security Oversight Committee and advises it to implement preventive measures. However, a major breach (for example leaking upcoming game assets) could delay projects or incur remediation costs, making cybersecurity an ongoing operational risk.

Content Regulation and Public Scrutiny: Several of Capcom’s flagship games contain violent or mature themes. The company notes that public or governmental backlash against video game violence can lead to negative publicity or even regulatory action. Capcom follows age-rating systems and conducts outreach (guest lectures, etc.) to mitigate this perception risk. Nevertheless, stricter content regulations (such as new laws on game content or aggressive enforcement of rating standards) could limit access in certain regions or increase compliance costs. Gaming regulators worldwide (in Europe, Asia and the U.S.) have also scrutinized in-game monetization. Although Capcom largely focuses on premium (pay-up-front) titles, its mobile strategy and online games could fall under such rules. New restrictions on loot boxes or chance-based items could reduce revenue opportunities or require reworking of game economies. Capcom aims to offer monetization that “does not pressure players”, but evolving global standards remain a potential concern. Similarly, Capom's arcade and pachinko businesses could be subject to stricter regulations going forward, narrowing the scope of business. Capcom must comply with data protection laws (GDPR, CCPA, etc.) and regional regulations (e.g. Chinese game licensing approvals). Failure to meet these standards can incur fines or sales bans.

Intellectual Property (IP) and Litigation: Capcom’s business relies on its own IP (many patents, trademarks and copyrights) and respect of others’. The company may face lawsuits for alleged infringement, and failure to secure or defend IP rights could impair its products. Capcom’s historical successes also make it a target for counterfeiters or unauthorized use of its characters (especially in fast-growing markets). While Capcom employs global IP management and monitoring to mitigate this risk, any significant litigation (either filing or defending IP suits) could entail legal costs and distract management.

Licensing and Platform Agreements: Capcom’s multi-platform strategy depends on licenses from console makers (Sony, Microsoft, Nintendo) and distribution platforms (Valve’s Steam, etc.). Any adverse change in these agreements (e.g. higher royalties, exclusivity restrictions or platform-specific requirements) could raise costs or limit market reach. Capcom acknowledges this risk and mitigates it by broadening PC and digital sales to reduce single-platform dependence.

Currency Exchange Risk: Roughly two-thirds of Capcom’s revenue comes from overseas markets. Capcom reports that it holds significant foreign-currency receivables and translates overseas subsidiaries back into yen, meaning that sudden FX moves (e.g. a rapid yen appreciation) could shrink reported earnings. The company uses foreign currency forwards to hedge against this volatility, but unanticipated currency swings (especially given the recent volatility in USD/JPY and EUR/JPY) remain a financial risk factor.

Taxation and International Trade: As a global company, Capcom’s profits can be affected by changes in tax regimes or trade policies. The risk management report flags potential burdens from customs, tariffs or tax audits as Capcom’s international footprint grows. While Capcom works closely with subsidiaries to ensure legal compliance, any changes in tax law (corporate tax rates, transfer pricing rules) or imposition of trade barriers could adversely affect net income.

Liquidity and Capital Allocation: Capcom has historically maintained a very strong balance sheet (cash reserves over ¥100 billion), which limits short-term liquidity risk. However, a potential risk factor is how this cash is deployed. If Capcom fails to find sufficiently profitable investments or acquisitions, or if it returns cash in stock buybacks, investors may worry about capital allocation. The company, however, has a history of disciplined capital management and record of shareholder returns, but it remains a focus for long-term valuation.

The stress test conducted here is randomized (probability weighted downward pressure).

Also, the ensuing forecasts below are not quite reporting grade, as some forecasting and analysis occurs directly on the sheets (which should never be done in a professional model) and some of the forecasted items rely on information the viewer may not have. For example, currency exchange over a 10 year horizon is forecasted to approximate to 0-sum changes as per purchasing power parity conditions, and Capcom uses Japan GAAP rules (as opposed to IFRS or US GAAP, which are considerably more common).

And my apologies to any mobile viewers in particular.

The next one is a credit analysis (also done on Capcom). Credit analysis is a way of issuing bond ratings after assessing the likelihood of default and some qualitative factors. Here I also go through the potential signs of accounting malpractice.

SUMMARY

Capcom appears to be clearly investment grade in terms of credit rating. KMV model predicts 0% probability of default over the 10 year horizon and there are no concerning Z- or O- scores over the time horizon. The Montier C-score never reaches 5 and averages 2, and while there are a couple years where M-score dips above -1.78, driven by decreased CFO, these are likely coincidence rather than signs of accounting fraud. The main risks come from product diversification, and impacts to the industry overall. Capcom's other factors clearly rank favorably in terms of high management quality, low leverage, strong ESG ratings, predictable cash flows, strong branding, high profit margins, and so on. Currently, Capcom's rating is A by Rating and Investment Information, Inc. This analysis suggests their credit rating will likely migrate upwards in the future.

FINANCIAL FORECAST

This one is the same as above, so I'm going to spare everyone's eyes.

ACCOUNTING WARNING SIGNS

There does not appear to be any convincing evidence of malfeasance with respect to accounting or business practices.

First, the non-GAAP/IFRS measures should be covered: Capcom follows the Japanese reporting standards (Japan GAAP), which differ from IFRS slightly, so this is unlikely to be a warning sign.

Income Statement:

The higher revenue growth compared to peers can be justified by IP strength and focus. Additionally revenue growth of this magnitude is not uncommon in the industry, where Konami, for example, achieved 14.6% YoY growth in FY2024 after 56 years in business. There doesn't appear to be significant allowances or returns. Capcom does not appear to deviate from industry standards in terms of discounts. The rate of change in recievables appears to be concerning in some years, however, there is no clear trend growth and it remains, historically, a relatively low percent of revenue. There is no intentional timing of revenue apparent across quarters. There are some periods where CFO appears small relative to EBIT, but this isn't common. This could be an effect of the volatile nature of the industry, as shown on the right, where peer companies do appear to dip well below the 100% line. Their operating margins have increased substantially over the years but this appears to have a reasonable basis in cost-cutting efforts mainly through a shift to digitalization (reduced COGS) and increased in-house development (sustained SG&A). Capcom does use long depreciable lives, but this doesn't seem to differ from industry norms in any significant manner. Directors recieve bonus compensation up to 50% of their salary, based on company performance, which likely deters excessive risk-taking and some aggression, as the majority of their compensation comes from sound operations. There doesn't appear to be any significant movements from non-operating income to net income or operating income.

Balance Sheet:

Assets and liabilities appear to be fairly stated and in the correct locations on the balance sheet. Allowances are low and not industry standard. However, this will have a minimal impact on the statements. Below, the allowance has been adjusted upward as a percent of accounts receivable to 1%, then current assets have been recalculated. The difference is largely immaterial. The company doesn't engage in regular acquisitions and has no goodwill on the balance sheet. Capcom does not appear to use special purpose vehicles or hold significant off-balance sheet items.

Statement of Cash Flows:

There is no apparent indication that the company is manipulating their cash conversion cycle by increasing accounts payable, decreasing accounts recievable, and decreasing inventory (see below). There are some capex items featured in investment activities (as opposed to financing) but this appears to be consistent across all time. Capcom does not appear to engage in Sale-Leaseback transactions. Capcom does not feature bank overdrafts on their financial statements.

The next sheet is the KMV model, which I am not going to showcase here (besides top line results) because it is basically lengthy iterations, with the idea being to minimize mispricing (the difference in market cap from the Black-Scholes model and actual market cap).

Some of the scores say the same thing, effectively. Z-score and O-score assess default risk; M-score and C-score assess the probability of misstatement. You should try to use multiple models as often as possible though to cover the limitations of individual models.